What We’ve Learned About How Homeowners Approach Home Improvement Financing

At Regions | EnerBank USA, we like to make data-driven decisions. That means gathering all the pertinent information so that we can analyze the inputs and create better outputs. To that end, some time ago, we commissioned a study to learn more about how homeowners approach home improvement financing and how that knowledge can help contractors make better decisions about how they offer payment options to their customers.

The Brickyard Study’s research included a sample size of 600 participants comprising 150 EnerBank customers and 450 non-EnerBank customers. Of those non-EnerBank customers, 150 had renovated in the prior 12 months, and 300 planned to renovate in the following 12 months.

Here are five important data points discovered through this study:

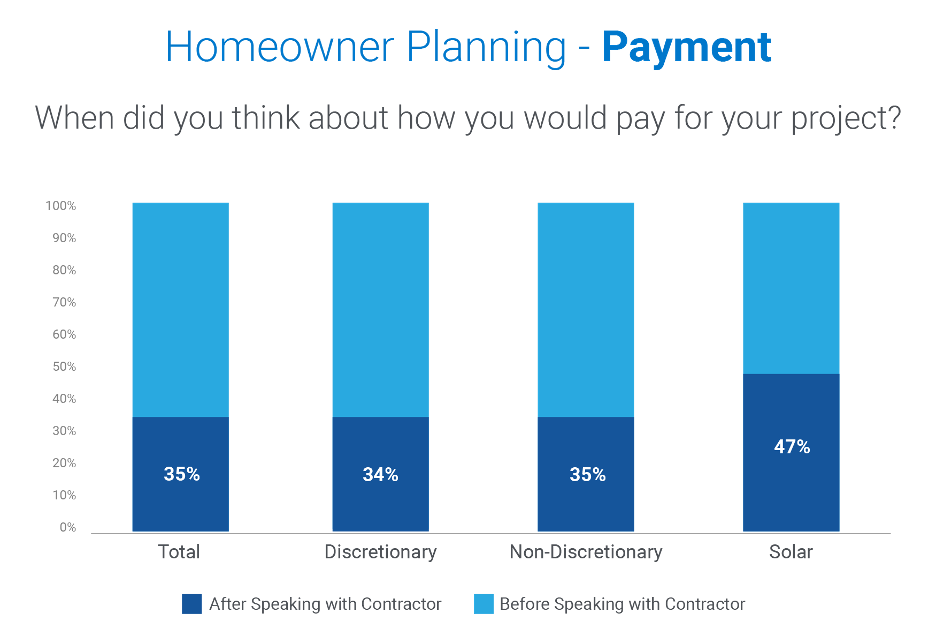

1) Many homeowners do not know how they will pay for a project until after they have spoken to a contractor.

On average, about 35% of homeowners enter the home improvement process with no clue how they’ll pay for the project. And their approach varies somewhat, depending on whether it’s discretionary spending (home enhancements) or non-discretionary spending (fixing problems). This low percentage means more opportunities for you as a contractor! When you offer a choice of appealing payment options to your customers — such as a Same-As-Cash Loan and a low monthly payment loan — your customer is much more likely to stay with you, and not seek additional bids from competitors.

In addition, customers may not always know that you’re able to help them obtain financing, and will value the benefits of a Same-As-Cash Loan or low monthly payment loan over their self-sourced financing. EnerBank loans are more appealing than other sources like credit cards, which often have higher interest rates. Compared to a home equity line of credit, contractor-offered payment options are also much simpler and quicker than the sometimes time-consuming and cumbersome process of a HELOC for consumers, while offering convenience and flexibility through multiple loan product options.

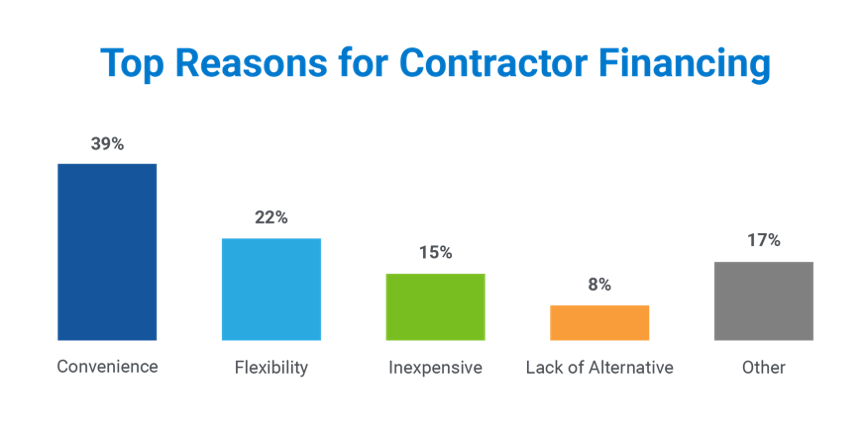

2) Speaking of convenience and flexibility, those are the two most-stated reasons for a homeowner to choose contractor-offered payment options.

As you can see in the chart below, 39% of the study participants identified convenience as their primary reason for financing their project. This was followed by flexibility at 22%.

Homeowners value the convenience and flexibility of contractor-provided loans, and homeowners are coming to expect that the contractor they select will offer financing. The truth is, some of your biggest competitors are already offering payment options and may be closing more jobs than you because of it.

In addition, this independent study shows that cash-paying customers value contractor-offered financing because it lets them use their money elsewhere. Notice that “Lack of alternative”

accounts for 8% of the responses. That means it’s not about affordability. Customers choose to finance because they value the convenience and flexibility it provides — not always because they have to — and they’re willing to pay more for it.

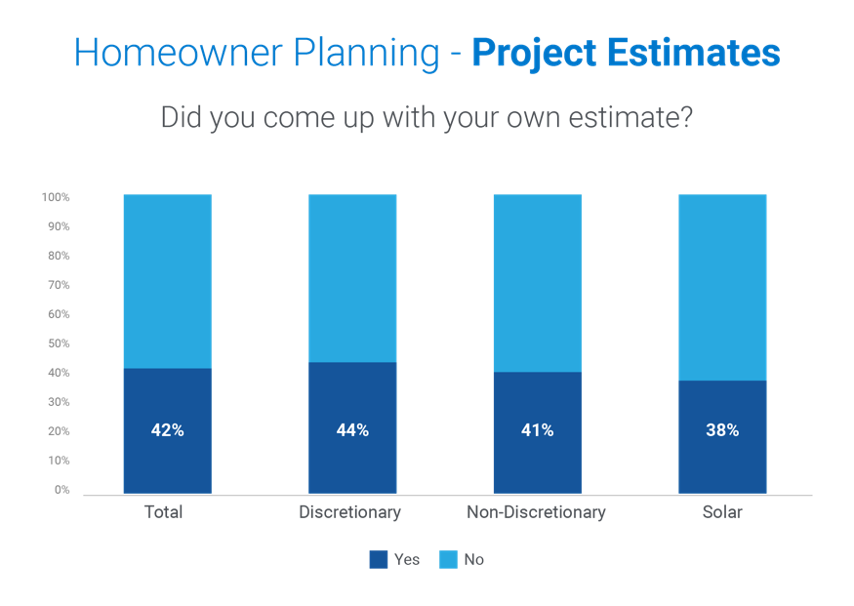

3) Almost half of homeowners come up with their own project estimate before having a contractor provide a bid.

So, why should you care if they came up with their own estimate? Here are two reasons:

- When the bid is higher than expected, and they don’t have a way to pay for it, they may reconsider. This wastes your time and resources — especially if you already visited their home.

- Second, they might try to get another bid. This puts your close rate at risk. When you’re the contractor offering appealing payment options, you have a higher chance of closing the project — not your competitor. Offering payment options significantly increases your chances of closing more sales.

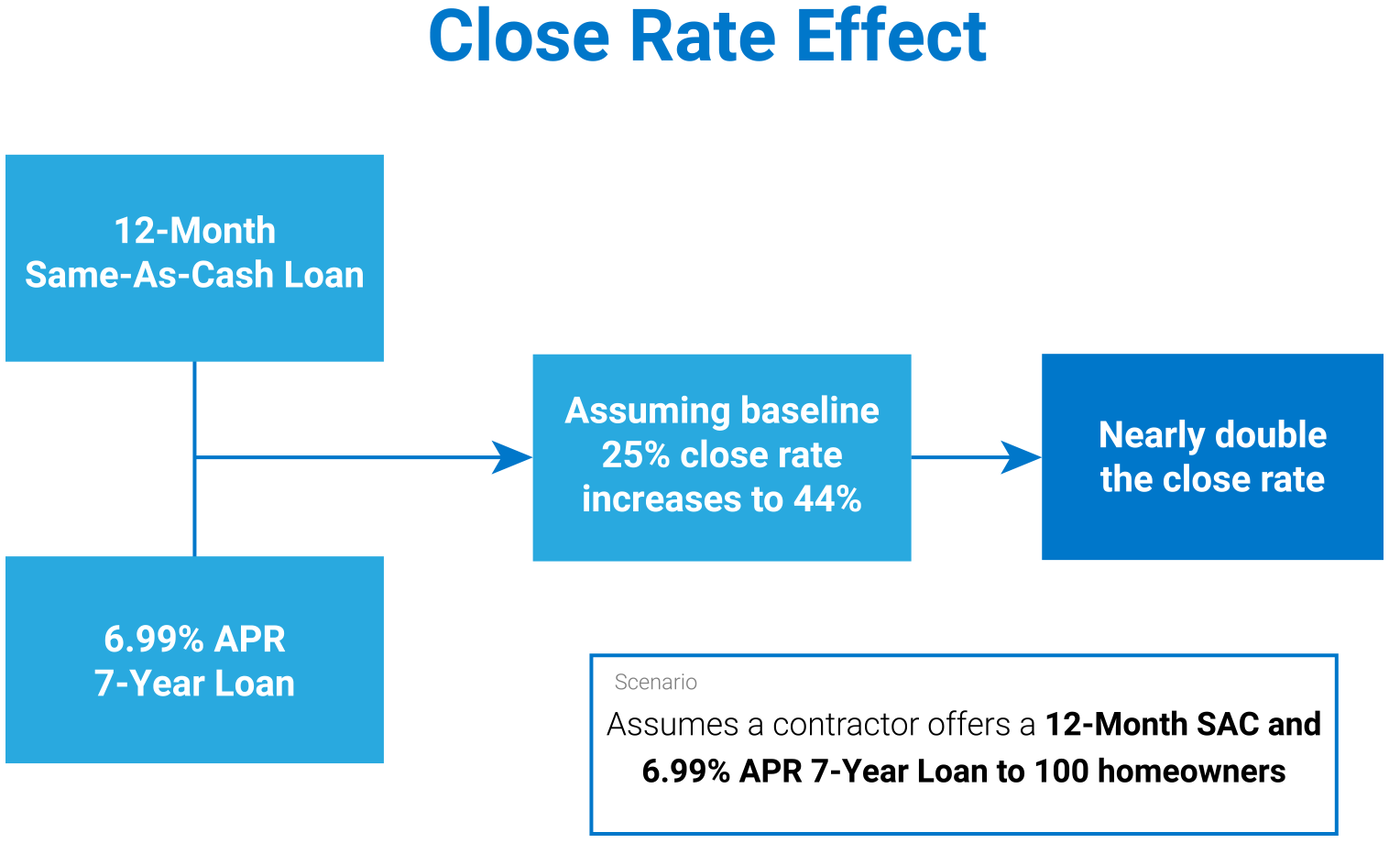

4) When your sales team uses best practices and consistently offers a choice of payment options, 100% of the time to 100% of customers, you’ll see a higher close rate than contractors who do not.

Every time your sales team offers a choice of payment options, you’re reducing your opportunity costs. You can really increase revenue if you simply offer a choice of payment options to all of your customers. It’s not uncommon to see significant spikes in sales, because this sales methodology truly works when you implement best practices.

5) Homeowners who finance their home improvement projects spend more.

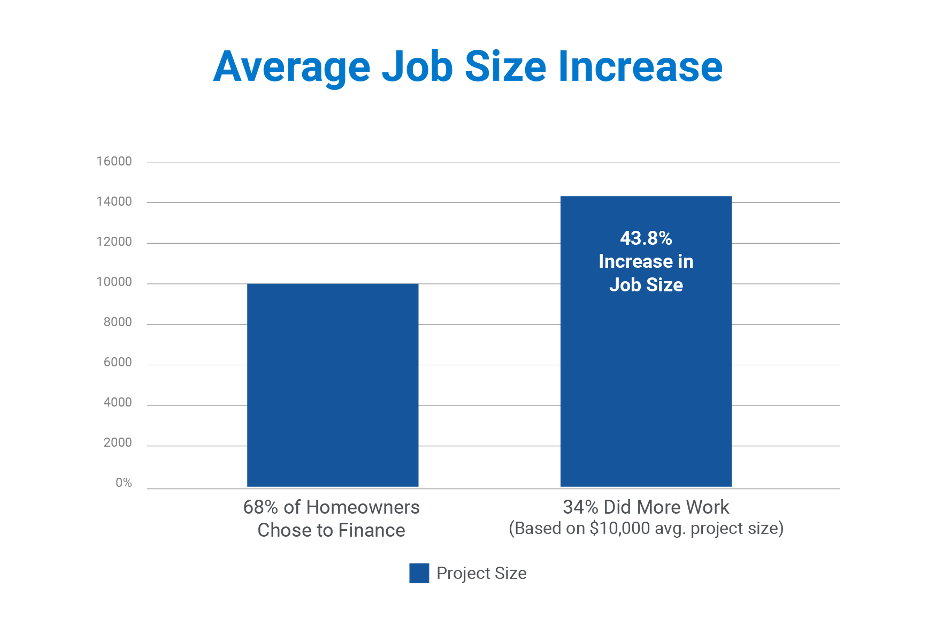

Based on an average project size of $10,000, homeowners who chose payment options purchased significantly larger jobs. In fact, the increase was over 40%!

This alone is a great metric to see how much more money you can make, thanks to increasing project sizes. Now, think about the increase in project size and close rates, decrease in cancellations and discounting. These effects snowball and grow your business quickly and consistently. It truly is a low-risk-high-reward solution to growing your business.

A better understanding of how your customers approach home improvement financing can help you grow!

Want to learn more? Fill out the form on this page or visit our website.

Blog Archives

No posts for Feb, 2025

PREVIOUS