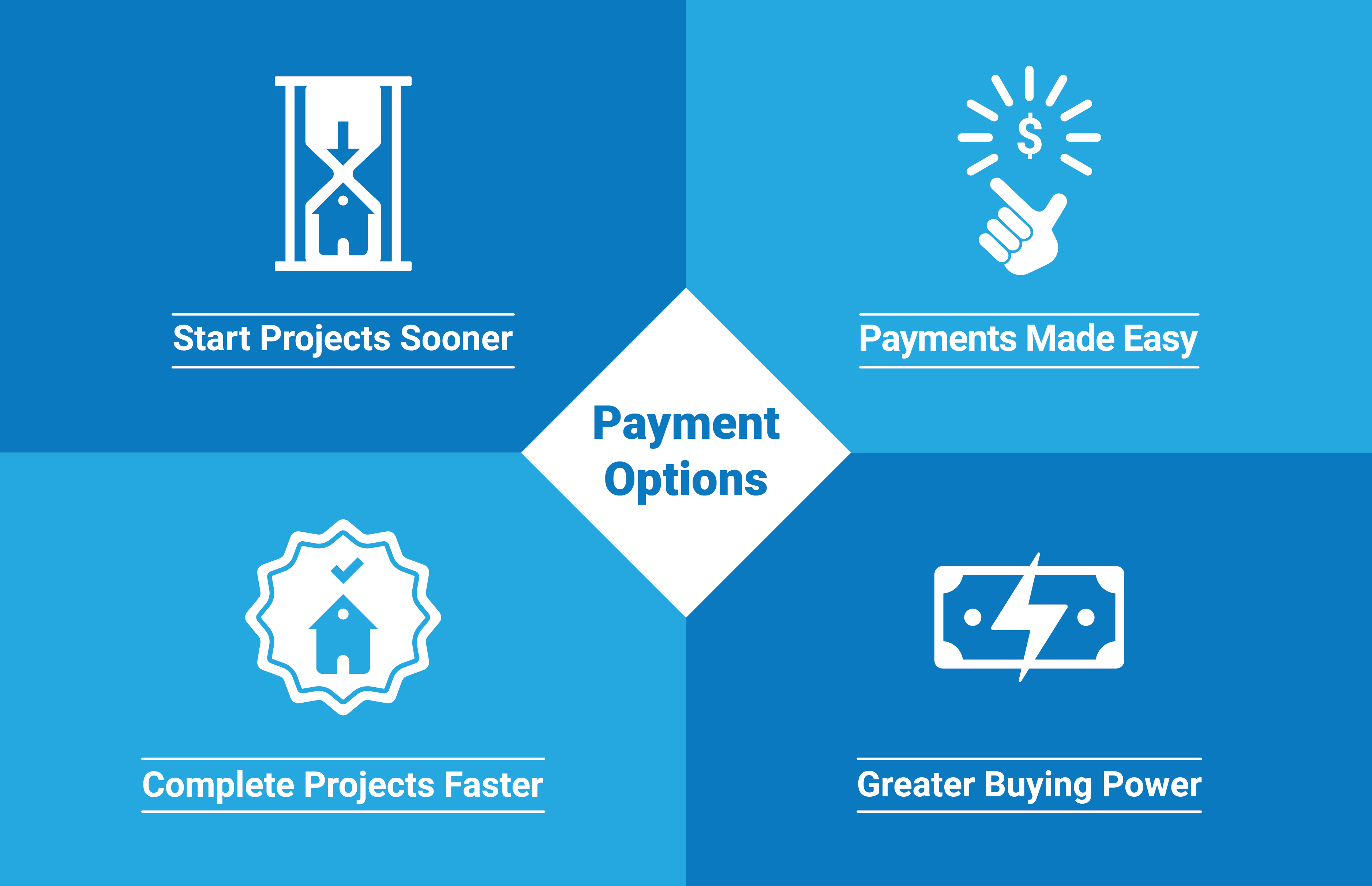

4 Reasons Why Financing Matter To Customers

Research shows that when you combine an attractive choice of payment options with your own high-quality home improvement products and services, your business can seriously grow. Financing helps you get more quality leads that lead to bigger jobs and happier customers.

How to Get Jobs as a Contractor

If you’re wondering how to get jobs as a contractor, there are many things you can do to give yourself a competitive edge. You might invest big money in a savvy new marketing strategy or search for the best and brightest talent in the industry. But there’s one tip that’s sure to consistently bring in new business — offering financing.

Why Does Financing Matter to Potential Customers?

Contractors who offer financing have a leg-up against others in the industry for numerous reasons, but the bottom line is that homeowners like a choice of financing options, and they’ll be more likely to hire you if you can provide a solid selection of home improvement specific loans. So why does financing matter so much to potential customers? Here are a few reasons:

1. Start Projects Sooner

Many homeowners may not be ready to start their home improvement projects without a loan, which holds them back from hiring you. Instead, they wait months to save up for the project or find the right financing option. But if they learn about your easy financing options right off the bat, they’ll be more likely to dive in right away. In fact, we’ve found that homeowners are 94% more likely to stick with you and commit to seeing the job through once they’re approved for a loan.

2. Payment Made Easy

Sometimes customers just don’t think about researching financing options. They don’t know where to look or how to get started, and they may not think to ask their contractor for loan choices. But by proactively mentioning the financing options you offer, you’ll solve the issue for your customers and make it easy for them to commit.

3. Complete Projects Faster

When you offer convenient financing, it lets customers complete projects sooner and faster than if they were to come up with the money on their own. Whether they have unexpected floor damage or want to remodel their kitchen, they can do it all with flexible financing options, and the reliable cash flow from a home improvement loan helps you, the contractor, to keep pushing ahead and get the job done.

4. Greater Buying Power

Some homeowners find themselves settling for a smaller, more cost-effective renovation because they’re not ideally positioned to complete their real dream project. But financing allows customers to have complete buying power, getting exactly what they want out of their home with no compromises. And that’s a huge selling point that translates to a bigger bottom line for you.

Learn More About the Payment Options You Can Offer

If you’re a contractor and interested in learning more about why you should offer financing, contact EnerBank today. We’re happy to show you how to close deals as a contractor with flexible, easy, Same-As-Cash payment options and more. Contact us now to get more information.

Blog Archives

No posts for Dec, 2024